how much is the nys star exemption

A reduction on your school tax bill. New York City residents.

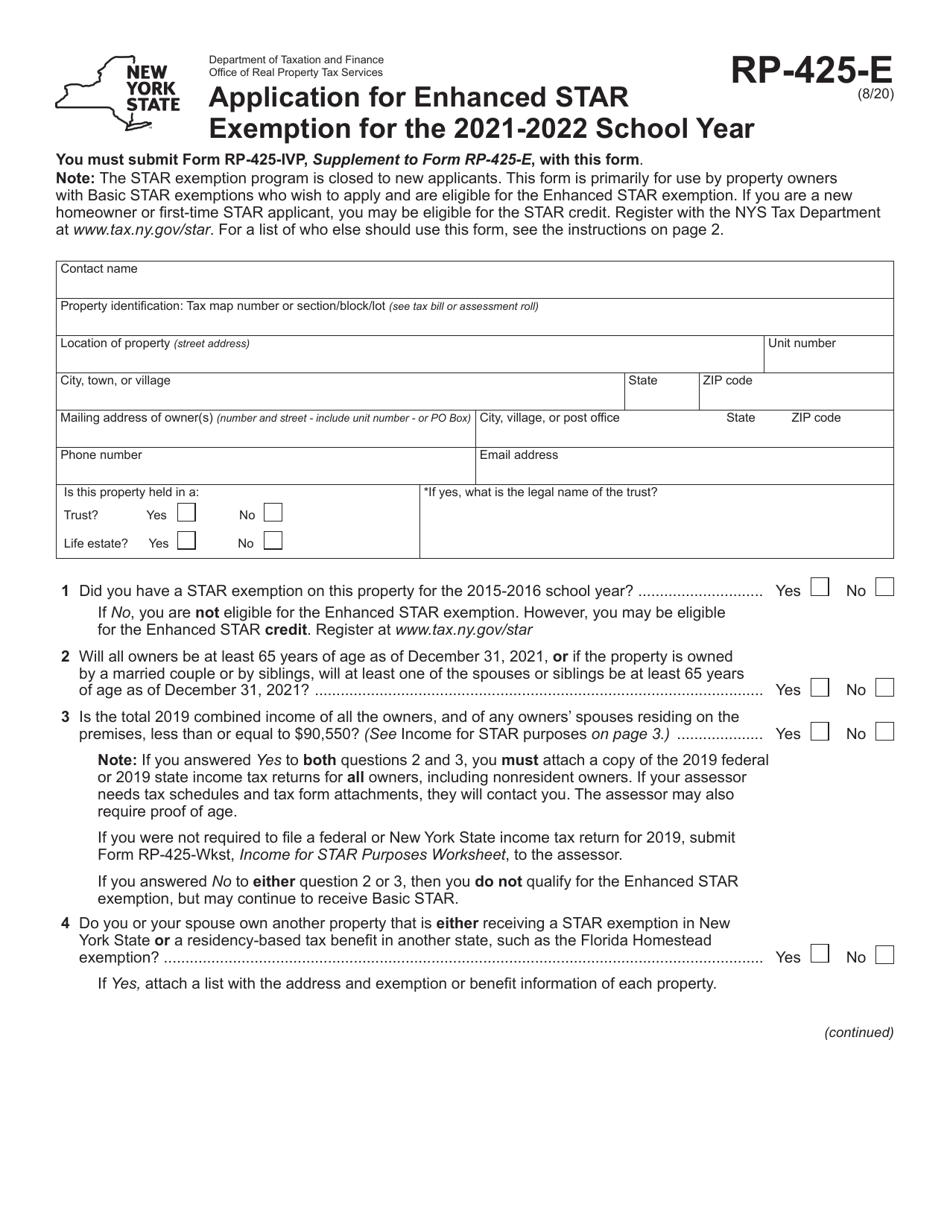

88050 or less for the 2020-2021 school year 90550 or less for the 2021-2022 school year.

. 34 what they get from Enhanced STAR regardless of their income. In this example 90805 is the lowest of the three values from Steps 1 2 and 3. Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application instructions above STAR forms.

The total amount of school taxes owed prior to the STAR exemption is 4000. Basic STAR is for homeowners whose total household income is 500000 or less. The Maximum Enhanced STAR exemption savings on our website is 1000.

Exemption forms and applications. How much do you save with enhanced star. 5 rows If you are currently receiving STAR or E-STAR as a property tax exemption and you earn.

You must register with NY State online at wwwtaxnygovstar or over the phone at 518-457-2036. While the maximum annual income eligibility requirement for Basic STAR remains unchanged at 500000 whats changed is that only those whose income is 250000 or less will be able to continue to receive exemptions on their property tax bill. Based on the first 70700 of the full value of a home for the 2021-2022 school year.

Provides an increased benefit for the primary residences of senior citizens age 65 and older with qualifying incomes. Basic STAR is for homeowners whose total household income is 500000 or less. However STAR credits can rise as much as 2 percent annually.

STAR exemption amounts. Beginning in 2016 any homeowner who is applying for the first time or a new homeowner will be required to register with the Department of Taxation and FinanceYou will be able to contact them directly at 518-457-2036 or register onlineYou will NO LONGER file your application with the Assessment Office. If youve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence.

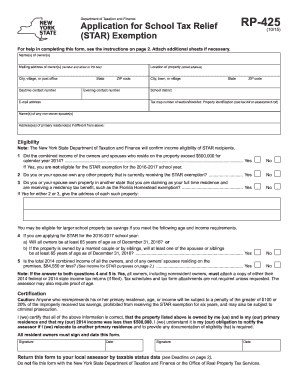

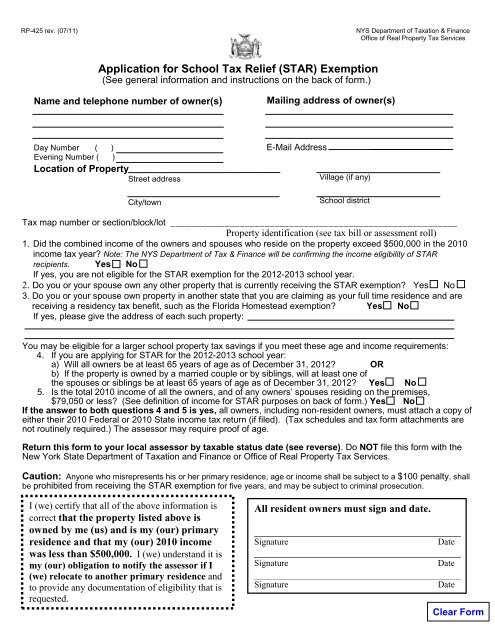

You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less. For more information see STAR credit and exemption savings amounts. This state-financed exemption is authorized by section 425 of the Real Property Tax Law.

As long as you. Residents of New York City or Nassau County. HOW MUCH IS THE STAR exemption in NY.

For those earning between 75000 and 150000 the rebate is 60 of what you receive in STAR. Those making between 250000 and 500000 will instead receive a check from New York State. Senior citizens also get a check.

Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is 92000 or less. The benefit is estimated to be a 293 tax reduction. It is 35 for households with income between 150000 and 200000 and 105 for between 200000 and 275000.

The Maximum Enhanced STAR exemption savings on our website is 1000. 74900 13123456 1000 90805. Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the prior year.

For instance if you live in Albany County in the City of Cohoes and your basic STAR exemption is 17340 and your homes assessment is 180000 you would subtract 17340 from 180000 to arrive at your homes value for local school property tax purposes of 162660. The Enhanced STAR exemption amount is 74900 and the school tax rate is 12123456 per thousand. The benefit is estimated to be a 293 tax reduction.

STAR is the New York State School Tax Relief program that provides an exemption from school property taxes for owner-occupied primary residences. To qualify the adjusted gross income must be under the State specified limit for the required income tax year 500000 for Basic 86300 for Enhanced and is eligible for a yearly 2 increase in the tax savings. STAR helps lower property taxes for eligible homeowners who live in New York State school districts.

In New York State the homestead exemption known as STAR for School Tax Relief allows homeowners in some counties to deduct as much as 1635 from their property taxes while those over 65 can deduct up to 2940. Since its inception in the 1990s STAR gave homeowners with annual incomes under 500000 an upfront rebate on their school taxes. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is 92000 or less.

How much is NYS Enhanced STAR exemption.

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

2021 Information For The Star Exemption Credit

The School Tax Relief Star Program Faq Ny State Senate

New York Seniors Reminded To Upgrade Star Exemption Rochesterfirst

Deadline For Seniors To Apply For Enhanced Star Exemption March 1

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Basic Star Property Tax Credit In Nyc Hauseit

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Ny Updates The Star Program Lumsden Mccormick

Star Property Tax Credit Make Sure You Know The New Income Limits Greenbush Financial Group

2015 2022 Form Ny Dtf Rp 425 Fill Online Printable Fillable Blank Pdffiller

All The Nassau County Property Tax Exemptions You Should Know About

Form Rp 425 E Download Fillable Pdf Or Fill Online Application For Enhanced Star Exemption 2022 Templateroller

Application For School Tax Relief Star Exemption City Of Albany